Get the free tax affirmation form

Get, Create, Make and Sign

How to edit tax affirmation form online

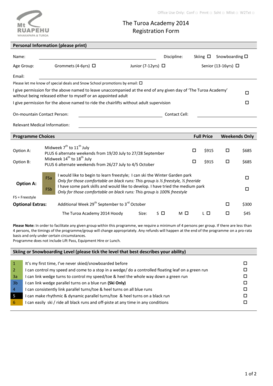

How to fill out tax affirmation form

Point by point instructions on how to fill out tax affirmation:

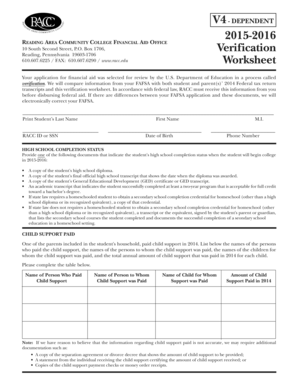

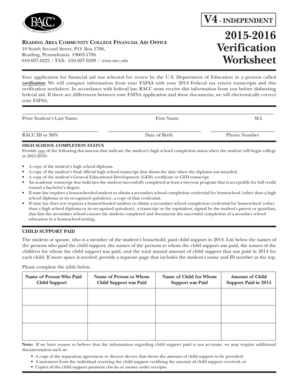

Who needs tax affirmation?

Video instructions and help with filling out and completing tax affirmation form

Instructions and Help about ny tax bidder affirmation form make

Recent Supreme Court activity has provided powerful affirmation and confirmation many of the powerful planning tax planning tools that Bridge ford truss company has been involved with really since our inception and what makes these court cases so particularly compelling at this point in time is because state tax planning has become a particularly hot topic in light of changes in the federal tax code, so the timing of these court cases couldn't be any better in June 2019 the court issued its decision in the Meissner case which was very important on several levels because it's the first case actually it's a first tax case coming out of Supreme Court in 60 years, but the court was specifically analyzing an issue that has been percolating around the United States for several years and that issue is very simply does a state have the constitutional authority to tax undistributed income inside a trust that's properly sites or properly in a jurisdiction like South Dakota that does not have a state income tax Bridge ford has been tracking this case for quite some time, and we've been telling our advisors and the advisor community about this development, and we're very excited to report that as anticipated the court's decision it was very consistent with where Bridge ford thought it would go in fact Rochford felt so strongly about this that we committed to fund an amicus brief along with other tress companies in support of the taxpayer in which we believe had an impact on the court's decision so what was the ruling in a unanimous decision the Supreme Court held that it was unconstitutional for North Carolina to tax undistributed income inside a trust that was properly sites in a jurisdiction that did not have a state income tax which was a resounding win not only for the taxpayer but for the trust industry overall the court focused its analysis on really a narrow question whether the beneficiaries' presence in domicile in North Carolina was enough to establish Nexus such that the state could tax undistributed income and again in a unanimous decision it was not enough to as I wish Nexus under the Constitution and subsequently we now know and we now have guidance that just a beneficiaries mere presence in a state will not trigger that state's ability to tax on distributed income also in June 2019 the court provided additional guidance on this very issue by denying cert in a yet another very important tax case called fielding the fielding case looked at the very same issue whether there was enough nexus with Minnesota such that Minnesota would be permitted to tax undistributed income under the Constitution in the fielding case the issue there was domicile of the settler unlike in Manner where the issue was domicile of the beneficiary and the court applying the same constitutional analysis that the supreme court applied in the Manner case concluded that domicile of the settler was not enough to establish enough nexus if with that state such that Minnesota...

Fill new york tax affirmation form printable : Try Risk Free

People Also Ask about tax affirmation form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your tax affirmation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.